Most of you would have gone through the budget and must be excited about the increase in the limits for taxation. Many of you will be wondering that where is Old Tax Regime in all these news? Lost somewhere? Indeed.

New Tax Regime vs Old Tax Regime

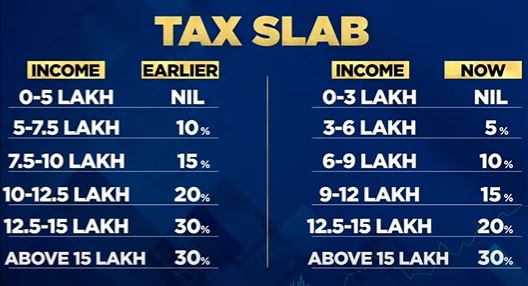

Before looking into the today’s changes lets take a look at what are the current tax slabs under Old Tax Regime and New Tax Regime;

The new rate slab changes are only applicable to the New Tax Regime and below are changes compared to previous financial year;

So, you see a massive relief for the middle class section of the society who are paying their taxes under the New Tax Regime, but what about the Old Tax Regime? Unfortunately, there are no changes to it.

Quoting the lines from the Budget Speech, here is what Shri Nirmala Sitharaman said;

“This will provide major relief to all tax payers in the new regime. An

individual with an annual income of ₹9 lakh will be required to pay only ₹45,000/-. This is only 5 per cent of his or her income. It is a reduction of 25

per cent on what he or she is required to pay now, i.e., ₹60,000/-. Similarly,

an individual with an income of ₹15 lakh would be required to pay only

₹1.5 lakh or 10 per cent of his or her income, a reduction of 20 per cent

from the existing liability of ₹1,87,500/. “

The whole rationale behind making this move seems to be more inclined towards bringing the New Tax Regime into play going further. Here is what else was quoted by Hon. Finance Minister;

“We are also making the new income tax regime as the default tax

regime. However, citizens will continue to have the option to avail the

benefit of the old tax regime.”

So, the intentions are quite clear from the Govt. of India on the future of taxation. Be mindful that 80C deductions are not part of New Tax Regime and thus the extra exemptions cannot be claimed under this regime.

There were anticipations of getting enhancements in the Standard Deductions and 80C limits. But, none followed, and by now you must be aware why it didn’t. Hope you all have a great upcoming financial year ahead!

We are soon coming up with an Income Tax Comparative calculator, which would make things easier for you to decide between the two. However, those who are falling under the earning slab of 15LPA and above will not find anything in their favor on this Budget.

Do follow PrTechNews for more such content!

If you want to read the entire Budget Speech do click the below link;