Buoyant markets tend to work favorably for those players that are part of the ecosystem. Brokerages, asset and wealth management companies and even private equity/investment players tend to be beneficiaries when markets are on a bull run.

Motilal Oswal Financial Services (MOFS) is one such well-entrenched firm that operates across the capital market ambit with a robust track record.

The company is a full-service brokerage, and is into investment banking, institutional equities, mutual funds, alternative investment funds (AIFs) and portfolio management services (PMS), and even housing finance.

With₹3.8 trillion in assets under advice as of March 2024, MOFS is a large player in the industry.

A diversified revenue mix with several growing divisions, steady increase in market share in businesses and a healthy treasury book are positives for the company.

At ₹2,151, the stock trades at a little over 13.3 times its per share earnings for FY24 and about 11 times its likely EPS for FY25. Even if we exclude treasury investment profits from the overall net profits of the company, the PE multiple for FY24 would be 16 times, and for FY25, it is likely to be 13 times. On a price to book basis the multiples for 3.6 times FY24 numbers and 2.8 times the likely FY25 figures.

At these valuations, MOFS trades at less than most wealth management and mutual fund peers.

Being deeply linked to the market dynamics, financial services stocks can be quite volatile during stiff corrections.

Therefore, investors with a medium to high risk appetite can buy the stock with at least a 2-3-year perspective.

Given that the share price has risen nearly 268 per cent in the last one year, investors can buy the stock in small lots on declines linked to the broader market.

In FY24, the company’s revenues grew 33 per cent over FY23 to ₹5,075 crore, while net profits rose 162 per cent to ₹2,441 crore over the same period.

The company has generally been able to deliver more than 50 percent in profit before tax margin over the past several quarters.

Multiple drivers

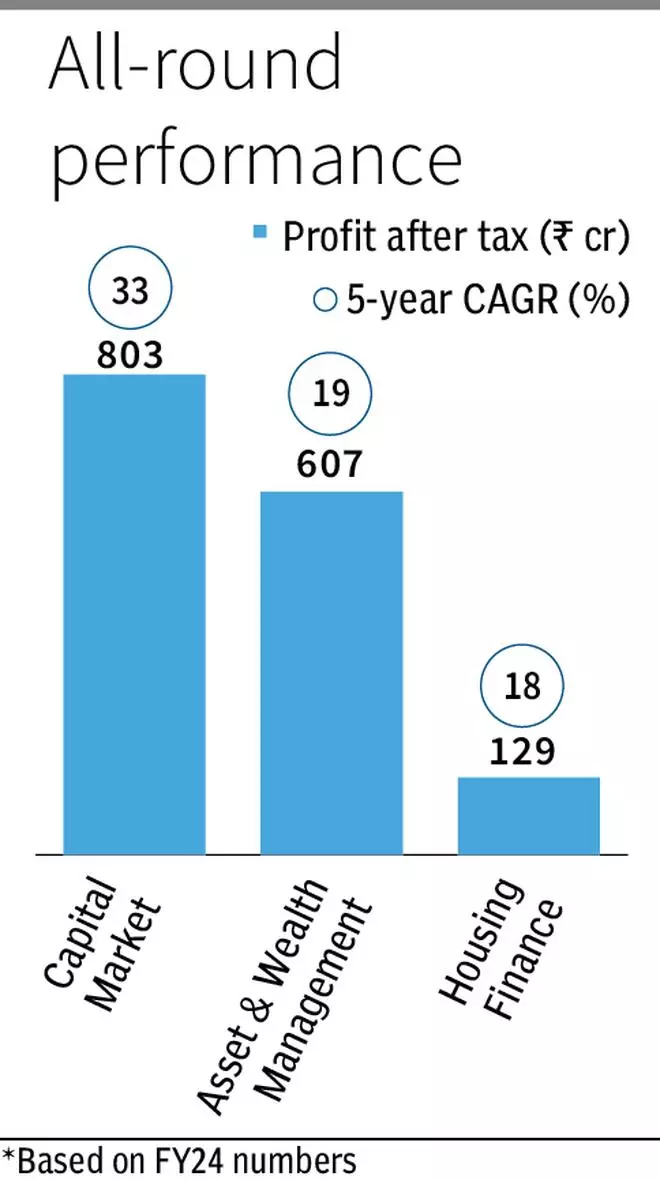

The capital markets division of Motilal Oswal Financial Services hosts many segments – brokerage, distribution, and investment banking. This division generates 60 per cent of the company’s revenues, with brokerage garnering a little over 39 per cent of the firm’s revenues in FY24.

It is among the top 10 brokerages in the country with an 8.2 per cent market share as of March 2024 (up from 5.1 per cent in March 2023) in the retail cash segment and 8.7 per cent share (up from 6.5 per cent in March 2023 ) in the futures and options premium market. Amidst competitive intensity in the brokerage business where discount brokers abound, MOFS has still managed to gain market share, indicating a fair degree of customer stickiness.

Its depository participant AUM grew at 48 per cent annually from March 2020 to ₹2.26 trillion by March 2024. The average daily turnover rose at 122 per cent annually from FY20 to ₹5.5 trillion by FY24.

Interestingly, even the distribution segment has risen sharply at 38 per cent annually, from ₹9,034 crore in FY20 to ₹27,038 crore in FY24.

Overall, the revenues from the capital markets division grew 37 per cent in FY24 over FY23.

From a macro industry standpoint, from FY14 to FY24, the total number of cash and F&O trades in the NSE have risen in every fiscal compared to the previous year, barring FY17. And demat account openings have skyrocketed in the last five years.

It is clear that there is a certain visibility in revenue for companies such as MOFS even when markets aren’t very conducive as trade volumes continue to pile up.

Other divisions thrive

The company’s asset and wealth management division, too, has been thriving and expanding rapidly.

MOFS focuses on the high net worth individuals (₹5 crore to ₹25 crore net worth) and ultra high net worth individuals (more than ₹25 crore) in its wealth management division. It also houses the private client group.

The wealth management segment has seen its AUM rise 72 per cent YoY over March 2023 and is at around ₹1.24 trillion as of March ’24. Since fees and charges are much higher in this division compared to typical retail products, the yields are robust for the company.

In the mutual fund segment, AUM has increased 57 per cent YoY and stood at ₹71, 810 crore as of March 2024. SIP market share has risen from 1 per cent in FY23 to 1.5 per cent in FY24. Total mutual fund folios have risen nearly three-fold, from ₹10.4 lakh in March 2020 to ₹29.6 lakh in March 2024.

Taking the company’s AIF, PMS and mutual fund strategies, 95 per cent by AUM have outperformed their respective benchmarks.

Private equity and real estate funds have also done reasonably well for MOFS.

The company has a robust treasury investment book worth ₹6,113 crore as of March 2024. It has grown at 25 per cent annually in the last four years from FY20. The XIRR is at a healthy 18.3 per cent.

MOFS also has a housing finance division with an AUM of ₹4,047 crore as of FY24. Growth has been moderate here. But asset quality has improved as gross NPA is just 0.9 per cent, while net NPA is 0.4 per cent as of FY24. Yield, net interest margin and capital adequacy remain healthy.