Gold Prices plummeted on Tuesday following a relaxation of tensions in West Asia over the weekend, as both Iran and Israel abstained from additional drone attacks.

Besides the de-escalation of war threats, huge profit-booking following the recent price surge and a resurgence in the US economy also exerted downward pressure on gold prices.

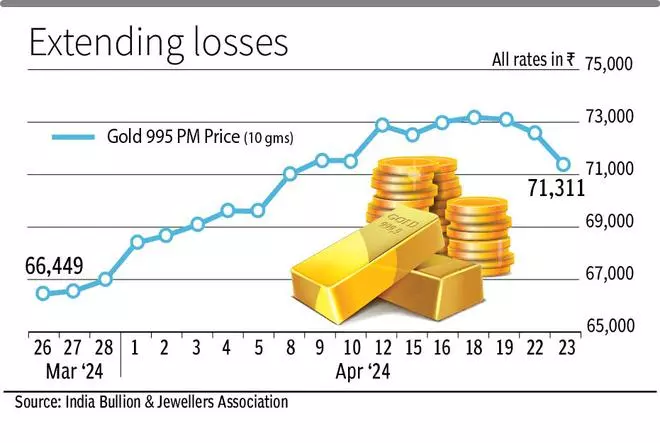

Gold prices have crashed ₹1,277 per 10 gram on Tuesday to ₹71,598. The fall in gold prices comes after an increase of ₹4,882 per 10 gram from the level of ₹66,716 logged on March 26 on the back of geo-political developments, according to the Indian Bullion and Jewellers Association of India data.

The fall in prices ahead of Akshaya Tritiya bodes well for boosting demand which was hit badly by the recent spike in gold prices.

On the MCX, the near month gold contract continued its downward trend and declined by ₹850 per 10 gram to ₹70,350 as the yellow metal in the US market slipped below $2,300 an ounce in a span of two days.

Jateen Trivedi, VP Research Analyst, LKP Securities, said the fall in gold prices was fuelled by easing tensions in the West Asia over the weekend, with both Iran and Israel refraining from further drone attacks.

Suvankar Sen, MD & CEO of Senco Gold & Diamonds, said the sudden decline in gold prices has stirred anticipation leading up to Akshaya Tritiya (May 10) and is prompting hesitant consumers to finally make their move.

Global cues

However, he said the global uncertainties continue to linger with the simmering tension between Israel-Hamas and Russia-Ukraine, besides the geo-political developments in South-East Asia and China and any bad news will make the gold prices jump again, he added.

Chintan Mehta, CEO, Abans Holdings, said signs of persistent inflationary pressure and hawkish signals from the US Fed, coupled with robust retail sales data reported last week and strong manufacturing activity, have diminished expectations of imminent rate cuts.

This has kept the dollar index and US treasury yields at near 5-month high, he added. However, the risk of geopolitical tensions might further push the prices upwards.