The deluge of feedback received on its July consultation paper to strengthen the index derivatives framework may make it tricky for the market regulator to arrive at the final norms and prompt a rethink on at least some of the seven proposed changes, said market watchers.

The proposals are likely to be taken up by the SEBI board this month but a final decision may be deferred, they said.

While the SEBI chairperson had, at a recent public event, said that 6,000 responses were received on the paper, the final figures could be in the range of 10,000-15,000. This is unprecedented as the number of responses on any consultation paper is typically in a few hundreds.

The high numbers could be the result of several individual traders submitting their responses and indicative of a largely negative response. “The likelihood of tweaks to the current set of proposals is very high. They will have to at least scan through all of the comments and have enough documentation to justify whatever decision they arrive at finally,” said a senior broker.

SEBI’s new proposals could reduce equity derivatives’ volumes by 30-40 per cent, impact exchange valuations and hit retail-focused brokers the most. “Some of the responses have come from non-serious players. We will do our best to take into account the opinions and views that have been submitted,” said a SEBI official. An email sent to SEBI did not get a response.

RTI Application

An RTI application has sought information from the market regulator on the number of responses received on its consultation paper along with the number of those who have given negative feedback.

Explaining the rationale for filing the RTI application, Rohit Jain, Managing Partner, Singhania & Co, a full-service law firm said, “A large number of responses were received on the proposals. The whole exercise of taking inputs from stakeholders should not be a mere eyewash and no regulatory change should be brought about without taking cognizance of the same.”

Based on the reply to the RTI query, Jain representing stakeholders, may approach the courts if required.

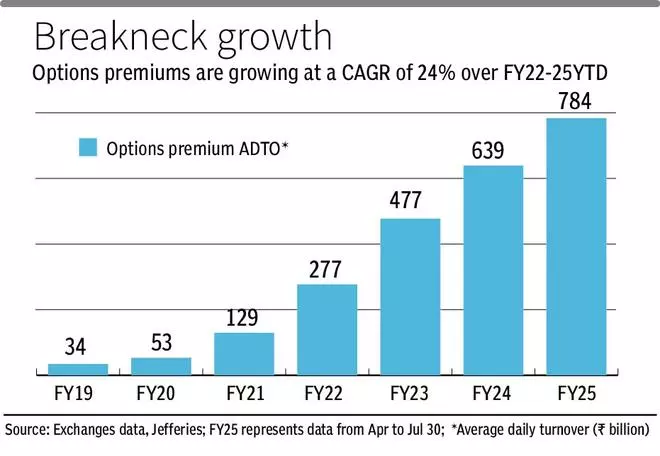

According to the July proposals, the regulator plans to increase the contract size for options contracts 3-6x times in phases, up to ₹30 lakh. Weekly options contracts will be provided on a single benchmark index of an exchange. Option premiums will have to be collected upfront from clients.

Existing strike price introduction methodology may be rationalized and the margin benefit for calendar spreads would not be provided for positions involving contracts expiring on the same day.