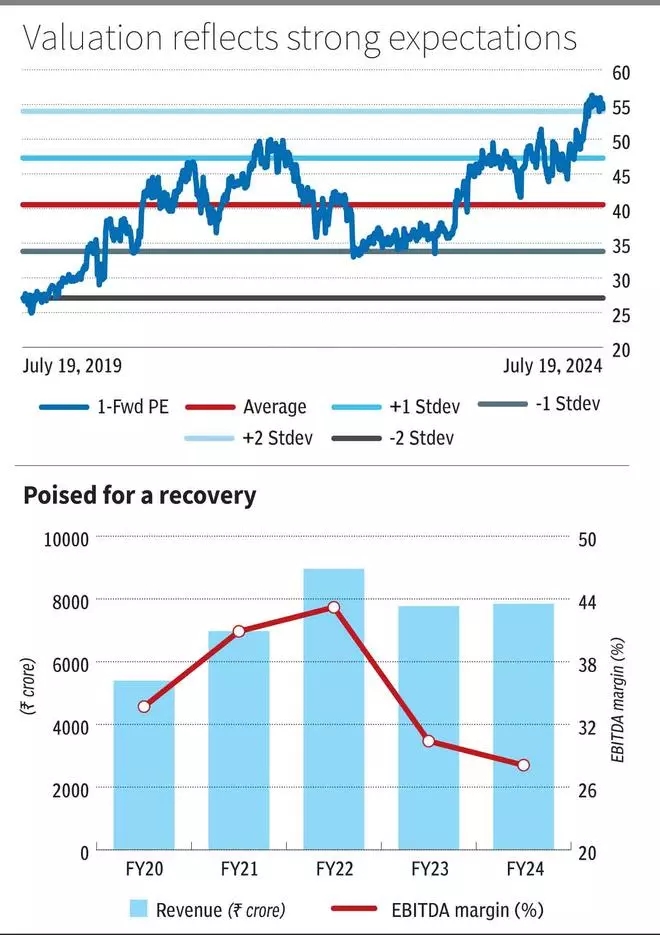

We recommended that investors accumulate Divi’s in December ’22, when it was trading at 33 times one-year forward earnings and hoping to get over the post-Covid dip in revenues. The stock is expected to regain its revenue momentum and is exploring next growth avenues, possibly aided by a structural shift as well. The valuation, though, has zoomed to 55 times, which stresses on the positives and ignores a few headwinds. We now recommend that investors hold on to the high-stakes investment until growth headwinds or the premium valuations are reconciled.

Divi’s operates three segments. Generics (40 per cent of Q4FY24 revenues), nutraceuticals (8 per cent) and custom synthesis (51 per cent). Generics segment operates a few large-volume APIs (around 20), which are fully backward-integrated and have 50-70 per cent of global market share. In custom synthesis (CS), Divi’s partners early to late stage developers in developing APIs for products in clinical trials and benefits from large orders once commercialized.

Growth Avenues

Divi’s is likely to expand its portfolio of generic APIs in its traditional manner — backward integrated for low-cost high-volume leadership. It expects patent expires in the next three years to launch seven more molecules. It has the requisite regulatory legwork (plant, product and trial paperwork) submitted. The company continues to expand market share in its existing portfolio as well.

In the CS segment, Divi’s is now working on late-stage products with higher likelihood of commercial supplies. Two new products were announced in Q3FY24, which should ramp up in the year. The company also announced dedicated capex for a product at a cost of ₹650-700 crore expected to be commercialized by FY27, partnering an MNC. The company also mentioned a surge in initial inquiries by customers, which should translate to commercial opportunities in the medium term.

US and European innovators diversifying from China, generally called China +1, got a regulatory boost with the US Congress considering a Biosecure Act, which tries to restrict partnerships with a few firms in China. Although limited to biotechnical collaboration while Divi’s is leading in small molecules, the general direction and company past commentary on higher interest seems to be aligned.

Divi’s has made headway in the small organic molecule space with GLP-1 products, currently the leading class in anti-diabetes with newfound application in weight loss. The company has developed three to four chain amino acids, which are key starting materials for GLP-1 class, and is expected to start supplies to innovators in FY25.

Along with GLP-1, FY25 is also expected to witness ramp-up in contrast media products. Three or four players control the segment worth $10 billion (at the innovator level) split equally between Iodine-based and Gadolinium-based products. Divi’s has made headway in Iodine-based profile and expects to achieve the same in the other this fiscal.

Divi’s has a record of capex-driven growth and is again in the midst of another round. Phase-1 of expansion in Kakinada worth ₹700 crore is expected to commercialize in FY25, which should aid both the segments. The Phase-2 (₹800 crore) and the new dedicated facility (₹650–700 crore) are expected to commercialize in the next two years.

Headwinds

There is pricing pressure in the business, which is evident in the lowered margin range of the company. Compared to 40 per cent EBITDA margin range in FY21-22, Divi’s reported 31 and 28 per cent in the last two years. Currently, generic APIs are in the price erosion cycle, which the company expects to have stabilized. The CS segment is also facing pricing downcycle as competition emerges. The new segments are not expected to substantially improve beyond adding 200-300 bps, which includes the generic pricing reversal and continued improvement in raw material costs. But the company has reported 32 per cent margin in Q4FY24.

Valuations are at a premium to the higher range that Divi’s usually trades at. Compared to last five-year average of 40 times one-year forward earnings, Divi’s is currently trading at 55 times, which is closer to two standard deviations above the mean. While the outlook on growth is strong, the high expectations will have to temper down before one invests in the stock. Consensus estimates expect 16/25 per cent revenue and EPS CAGR in FY24-26. But that is on a low base of revenues (which lost Covid contribution) and earnings impacted by low margins.