A hidden Chinese hand is behind gold’s current run to a record high apart from hopes of US Fed’s interest rates cut, weak dollar and geopolitical tensions. Gold soared to a record $2,222.49 an ounce earlier this week, before settling at $2,170 during the weekend.

sample this. A small jewelry shop in Shuibei Jewelry Park in Shenzhen, China, has sold over 100,000 pieces of 24-carat “gold beads” in the past six months. Each bead, made from pure gold, weighed 0.03863 troy ounces (1.2 grams). If the total weight of the sale of these beads is taken into account, then, 3,863 troy ounces or 120 kg of gold have been sold from the shop.

Eric Yeung, known by @KingKong9888 on X (formerly Twitter), posted: “Gen Z in China is buying small 24-carat gold beads. They are collecting them with a portion of their paychecks every month. This isn’t just a transaction but a symphony of aspirations,” he said.

Also read: Three factors why gold will glitter in 2024

Large flow of consumers

Chinese wire agency translations xinhua reported massive line-ups to buy physical gold ahead of the Spring Festival holiday. “Gold shops in the country have seen a large flow of consumers, many of whom are young people,” it said.

According to Jan Nieuwenhuijs, a numismatic expert and journalist, there has been exceptionally strong demand for gold from the Chinese central bank and the private sector. “The People’s Bank of China (PBoC) bought a record 735 tonnes of gold in 2023, of which about two-thirds were purchased covertly. In addition, the private sector net imported 1,411 tonnes in 2023, and a whopping 228 tonnes just in January of 2024,” he wrote on Gainesville Coins website.

ING Think, the economic and financial analysis wing of Dutch financial services firm ING, said latest data from China Customs show that gold imports in China jumped 53 per cent year-on-year to 372.2 tonnes in the first two months of 2024.

This was due to increased demand during the Lunar New Year peak consumption period. It was the highest purchase recorded for the two-month holiday season since 2017, ING Think said.

making up 26% of demand

“China is accumulating gold because it is not confident of the dollar’s performance as it holds US treasury securities,” said a trade analyst.

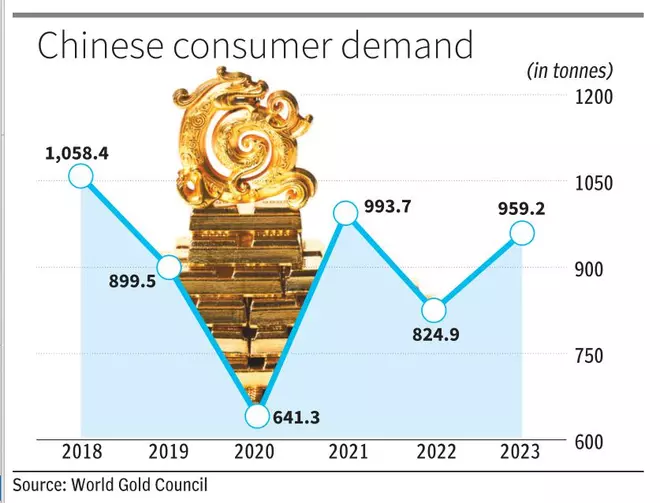

China’s holding of US treasury securities was $816 billion in December 2023. Its gold imports were at a 5-year high in 2023 and demand was higher than the 5-year average of 863.72 tonnes.

Bai Xiaojun, CEO of Investment, tweeted on X last week that gold merchants in major Chinese cities are complaining that their stocks have not been replenished after sales. “Physical gold bars have sold for $2,580 an ounce, and physical silver bars have risen sharply to $31.1 an ounce,” he said.

According to Xiaojun, China has come up with a blockchain technology that circumvents monitoring by the international financial system to create a new payment procedure supported by hard assets.

The London Bullion Market Association says China accounted for 26 per cent of global gold demand in 2023 against 7 per cent in 2003. “Jewellery demand more than trebled and, once the prohibition of private ownership of gold bullion was lifted in 2004, investment demand soared,” it said.

Shift in pricing power

The World Gold Council said China’s gold reserves increased for the 16th consecutive month in February. Data show the PBOC has purchased gold continuously since November 2022, bringing total reserves to 2,257 tonnes.

Saving intentions of Chinese households hovered around record highs in 2023 and it benefitted the yellow metal given its long-held status as a store of value, said the WGC.

“As asset volatility was heightened by China’s ailing property and stock markets, a weak yuan and an unstable political environment, more Chinese people have turned to gold, viewing it as the best means of preserving their wealth,” it said.

According to Peter Spina, President of GoldSeek.com, the pricing power for gold is shifting from “gamblers in the West to the savers in the East”.