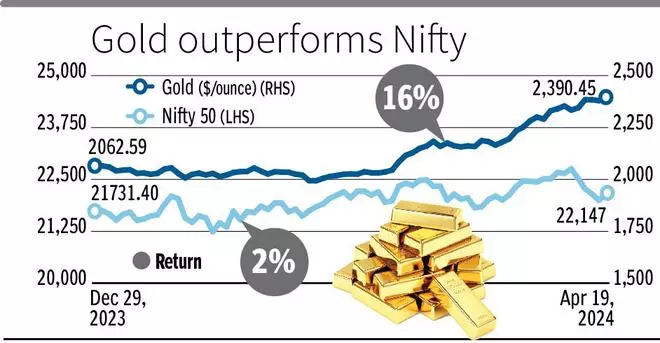

Gold appears unstoppable, skyrocketing so far in 2024, particularly since early March. The yellow metal, which ended at $2,390 per ounce on Friday, has appreciated 16 per cent year-to-date (YTD). Similarly, in the domestic market, gold futures, at ₹72,806, gained 15 per cent. In recording this stellar gain, gold has outperformed equities so far this year, with the Nifty50 and Dow Jones up only 1-2 per cent.

So, what’s driving gold prices and what’s in store?

Central bank actions

In early March, weak data set from the US, like a drop in consumer sentiment, increase in unemployment rate etc., led to the market believing that the rate cut is arriving soon. This led to softening of the US dollar and treasury yields, and a set off a rally in gold.

However, the inflation print in the US has been coming in hotter-than-expected and it shows a rising trend in the first three months of 2024. The US Consumer Price Index (CPI) stood at 3.1, 3.2 and 3.5 per cent in January , February and March respectively. This is holding the Fed back from initiating the rate cuts. This news is not good for gold because while both gold and bonds are considered as safe assets, the latter is yielding a higher interest rate when gold is a zero-yield asset. Nevertheless, the uncertainty with respect to the timing of the rate cut by itself is pushing the gold prices up.

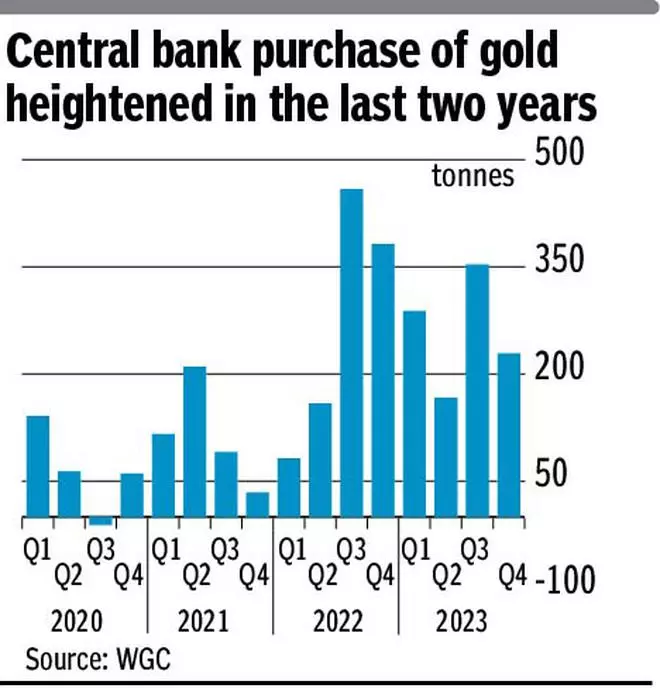

Apart from this, the central banks across the world have been steadily purchasing gold since Q2CY2022. In 2024, too, emerging market banks such as China and India, have been increasing their gold reserves, pushing up the demand for the yellow metal. Over January and February this year, the total central bank net additions stood at 64 tonnes, according to the World Gold Council (WGC). China’s central bank said it added another 5 tonnes in March, marking 17th consecutive monthly buying.

Money manager interest

Not just the central banks, of late, money managers too are showing interest in gold. The WGC noted that the strong performance of gold in March, when most of the YTD gain occurred, can be attributed to futures investors and green shoots from US gold ETFs (Exchange Traded Funds).

The Commitments of Traders (COT) report by US Commodity Futures Trading Commission (CFTC) indicates that money managers have been buying gold futures. The COT report shows that net long (total gold futures long less total gold futures short) of managed money, reported.

In terms of number of Open Interest (OI) contracts outstanding, expanded by about 2.4 times to 134,736 contracts on April 16 versus 56,153 contracts on February 27. This data hints that money managers had a significant role in pushing the gold prices to record highs recently.

On the other hand, although outflows from global gold ETFs continued in March, the pace was much slower than the previous months. Regionally, the outflows from the European funds were cushioned by inflows in the North American and Asian region.

Notably, the North American funds witnessed turnaround in March as they added a net $360 million worth of gold. Asia added $217 million in March, recording inflows for the 13th straight month.

Another reason for investors to look up to gold is the recent flare up between Israel and Iran, which has further raised the fear of a widespread conflict in the Middle East.

Outlook

In our yearly outlook published on January 14, 2024, we forecast gold price to hit $2,300 in dollar terms and gold futures to rally to the ₹70,000-72,000 price band. With these levels already being breached, what’s in store?

Going by the charts, gold displays a strong uptrend in the near to medium term. Although there might be some intermittent corrections, technically, the price band of $2,250-2,300 can be considered a demand zone. Until these levels stay true, there won’t be a threat to the broader uptrend which could take gold to $2,500. However, on the fundamental side, much could hinge on the Fed action too.